Financing for Development: What’s the private sector’s role?

Photo Courtesy of UNICEF/Campeanu.

This week heads of government, campaigners, experts, advocates and the private sector are gathering in Addis Ababa, Ethiopia for the Third International Conference on Financing for Development (FfD) — a high-level ground rules for investing in the post-2015 Sustainable Development Goals (SDGs) to be launched at the UN General Assembly in New York in September 2015.

In the grand scheme of achieving the U.N.’s goal of ending world poverty and hunger and achieving sustainable development, this conference is big. In thirty-plus pages of draft desired outcomes of the conference, 134 key points are outlined that will help mobilize resources so that, by 2025, public spending will reach a minimum of $300, per person, per year, and by 2020, $1 trillion per year globally will be invested in low-cost, low-carbon infrastructure projects among other aims.

Even though progress was made during the first decade of the implementation of the MDGs, progress has slowed and, in some sectors and communities (eg primary education) that progress has stalled. Now, gaps between the rich and the poor are on the rise. Today, more than 124 million children and adolescents are out-of-school — an increase of 2.4 million from 2010 to 2013. Half of these primary-school aged children live in sub-Saharan Africa and in South and West Asia, 80 percent of girls are unlikely to ever enter school.

The achievement of the ambitious new SDGs will not be possible without the contributions of the private sector. “We need trillions, not billions, of dollars to accomplish these goals, and the money will come from many sources: developing countries, private sector investment, donors, and international financial institutions,” Jim Yong Kim, President of the World Bank Group said in a statement released the same day that the U.N. Secretary-General Ban Ki-moon called on all sectors to “overcome narrow self interest in favor of working together for the common well-being of humanity.”

Photo Courtesy of UNECA.

These world leaders are considering all forms of investment valuable, including direct philanthropic aid, public private partnerships, infrastructure (such as building schools), social impact bonds, new technology that helps reach the poorest, research and development, and tax revenue. However, what these investments should look like and how these investors can simultaneously focus them while scaling them up for the very poor is a subject of some debate.

The U.N. Industrial Development Organization (UNIDO), for example, emphasizes the power of public-private partnerships (PPPs) for their sizeable inclusion of all stakeholders, the participation of which is needed to fully realize international development objectives. (Check out Hess Corporation’s PRODEGE program to learn more about PPPs.) For social sector investments, Brookings Institution suggests the private sector either opt for early stage capital or social impact bonds as a means to scale up reach. Asian Development Bank’s Vice President of Private Sector and Cofinancing Operations Lakshmi Venkatachalam argues the private sector should focus on providing direct employment to the regions that need it most, since the private sector accounts for nearly 90 percent of the world’s jobs.

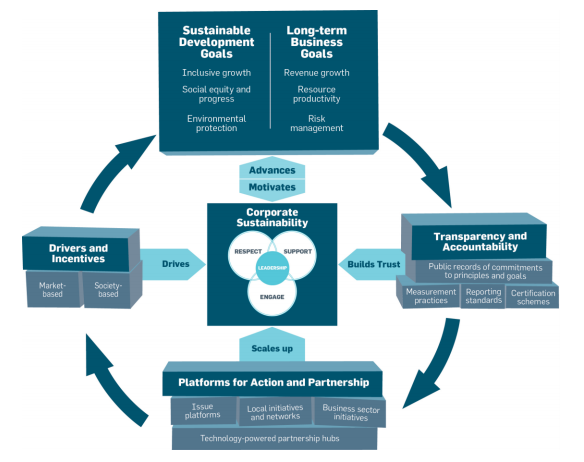

Photo Courtesy of the UN Global Compact.

Whatever the investment, transparency of financial flows has been highly prioritized by world leaders influencing the evolution and financing of the SDGs. By the end of 2017, sustainability reporting among the private sector will also be commonplace and more standardized thanks to 20 of the world’s top institutional investors who will endorse such best practices, as one goal of the FfD draft points out. The ability to form and sustain global partnerships for sustainable development will also be more fluid. Partnerships that flow across regions and sectors is suggested in the FfD since they would encourage economic growth, especially by promoting long-term private and public investment. The thought is that, if those investments are targeted and “productive,” they would in turn boost improvements in infrastructure and develop a more robust workforce (one that is both inclusive and supportive of educated and skilled workers), and empower those who were left behind by the Millennium Development Goals (MDGs).

As the FfD discussions continue to unfold in Ethiopia, the role of the private sector in contributing to sustainable development across the globe will remain immensely important.